You can create your trading strategies by dragging and dropping various blocks in the Visual Strategy Editor to compose your trading strategy.

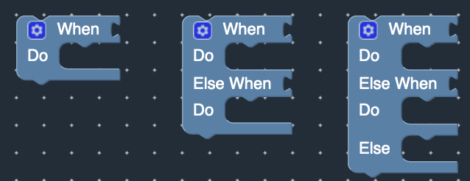

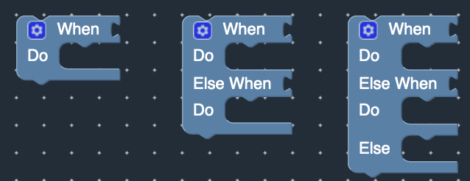

- WHEN Block – used to perform certain actions WHEN specific trading signals / market conditions occurs. Trading signals can be based on technical indicators (i.e. Bollinger Bands, etc), calendar events (i.e. earnings dates), and/or portfolio attributes (profit targets, greeks, etc).

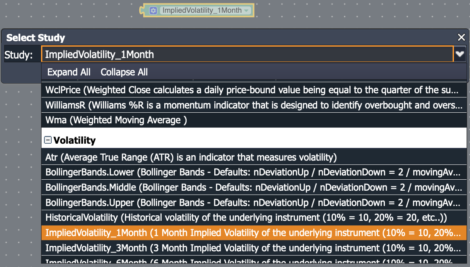

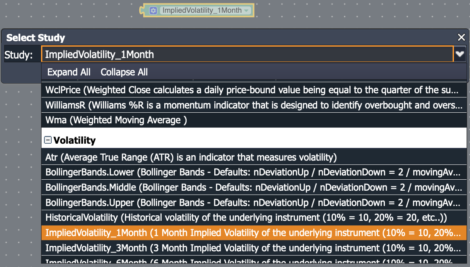

- Market Studies Block – contains hundreds of different technical, statistical, volatility studies. It can be attached to the WHEN Block to construct your entry / exit trading signals.

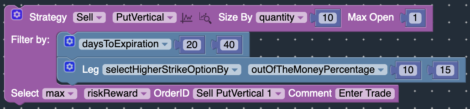

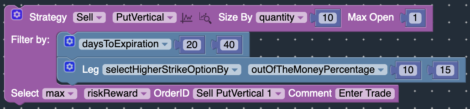

- Strategy Block – used to define the stock and option strategies to trade. It contains various features that will allow you to customize your trades to your specific requirements.

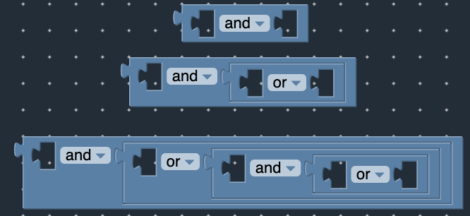

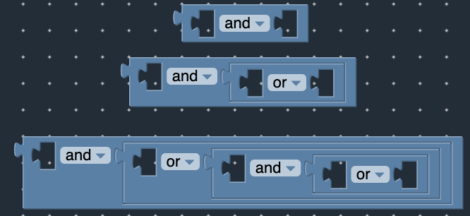

- Logic Block – used to define certain logical expressions (equals, greater than, isBetween, crossesOver, etc.) as well as boolean conditions (AND, OR).

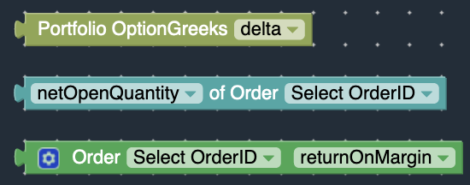

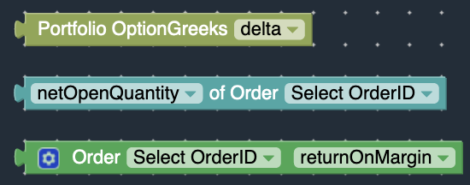

- Portfolio Studies Block – can be used to create rules based on the position’s statistics / attributes, such as greeks, breakeven points, ROI, stop loss, profit targets, etc…

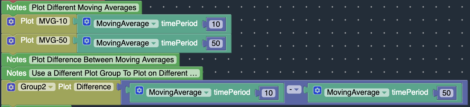

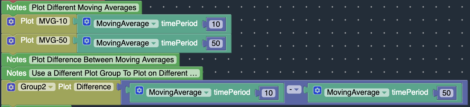

- Plot Block – can be used to plot stock prices, technical studies, profit/loss of the positions, option greeks, etc.

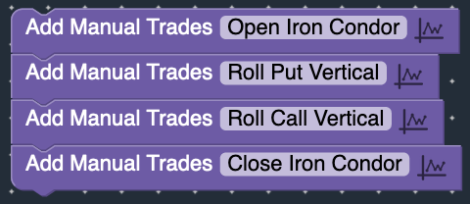

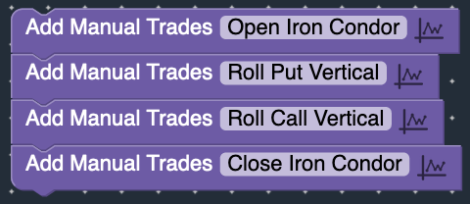

- Manual Trade Block – can be used to perform traditional manual backtesting, in addition to automated backtesting.

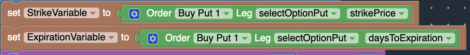

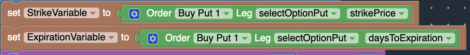

- Variable Block- can be used to create variables that reference specific attributes of your portfolio, positions, technical studies, etc.