How Can We Help?

Build Your Strategy

There are TWO steps to defining your trading strategy:

- First, define WHEN you would like to make a trade.

- Trading signals can include market / technical studies such as Bollinger Bands, implied volatility, earnings dates, etc..

- Trading signals can also include portfolio attributes such as profit / loss, ROI, option greeks (i.e. delta), breakeven points, etc..

- Second, define WHAT you would like to trade WHEN your trading signals are triggered.

- Trading actions can include opening a position, closing a position, rolling a position, legging into a position, etc..

We will use the following example case study below to explain the steps:

Example

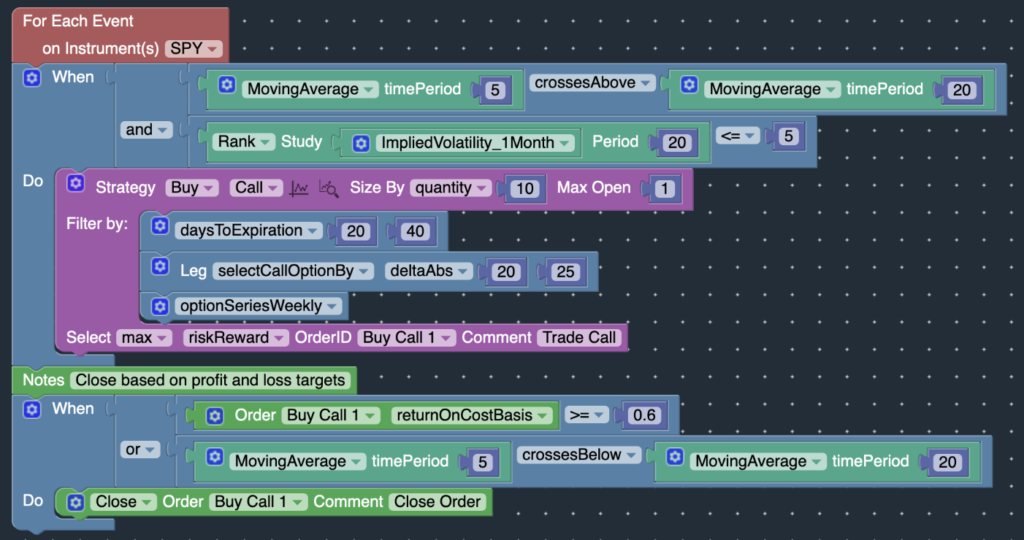

Buy SPY weekly 20-delta calls when the 5-day Moving Average crosses above the 20-day Moving Average, but only when Implied Volatility is near a 1-month low. Close calls when 5-day Moving Average crosses below 20-day Moving average or when 60% profit has been achieved.

Run Example!

Define When To Trade

The first step in constructing your strategy is to define the market conditions in which you would like to execute a trade. You can use the Market Studies Block to select from hundreds of available market studies, including technical analysis, volatility analysis, etc… You can use the Portfolio Studies Block to track the statistics of your portfolio (profit/loss, option greeks, etc) to adjust your trades based on certain portfolio targets.

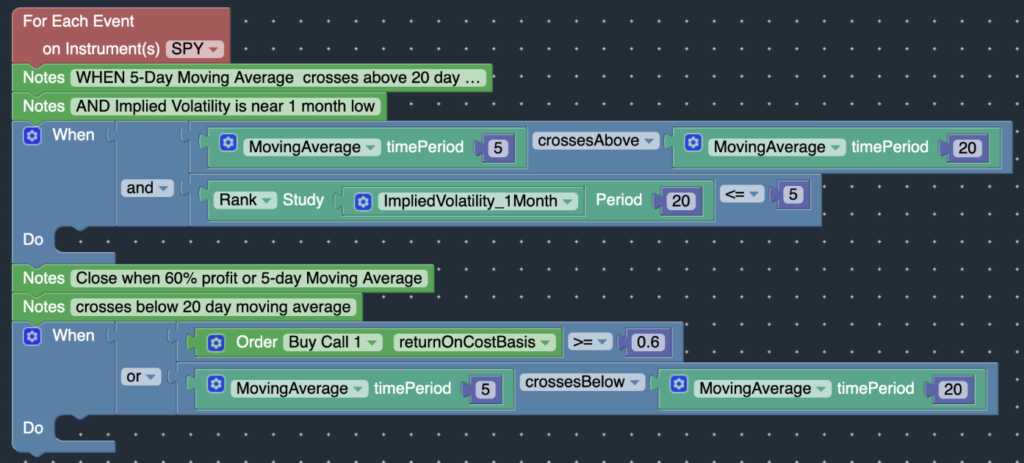

- Break down your strategy into a series of WHEN conditions using logical operators (AND/OR):

- WHEN 5-day Moving Average crosses 20-day Moving Average [AND] Implied Volatility is at 1-month low –> Buy SPY weekly 20-delta calls

- WHEN 5-day Moving Average crosses below 20-day Moving Average [OR] 60% profit has been achieved –> Close SPY Call

- Take each of the WHEN conditions, and construct the appropriate blocks using the Market Studies Block, Portfolio Studies Block, and Comparison Block.

Define WHAT To Trade

You can use the Strategy block along with the Strategy Filters to construct the specific trade you would like to execute.

- Construct the desired trade using the Strategy block:

- delta: 20 – 25

- optionSeriesWeekly: weekly options only

- daysToExpiration: 20 – 40 days

- To preview this trade, click on the Magnifying Icon on the Strategy block

- Place the Strategy block in the WHEN block. The Strategy block should be place inside the body of the WHEN block, and NOT above or below the WHEN block.

- In order to close the trade, use the Close Block and place inside the appropriate WHEN block to close the position.

- The final strategy looks like the following: