How Can We Help?

Roll Your Trades

Rolling is one of the most common ways to adjust an option position. To roll a trade, we simultaneously close our existing position and open a new one. Rolling can also be used to “leg” into a larger position or simulate portfolio rebalancing strategies.

It’s possible to roll either long or short option positions. When we roll a position, we can adjust the strike prices on the options, change the expiration dates, as well as increase / decrease the position size of the trades. In addition, existing positions can be left open, instead of closed, in order to leg into larger positions.

These strategies may be used to protect profits or hedge against losses. But rolling is never guaranteed to work. In fact, we might end up compounding our losses.

Fortunately, backtesting rolling strategies can be easily accomplished using OptionStack.

Rolling Covered Calls

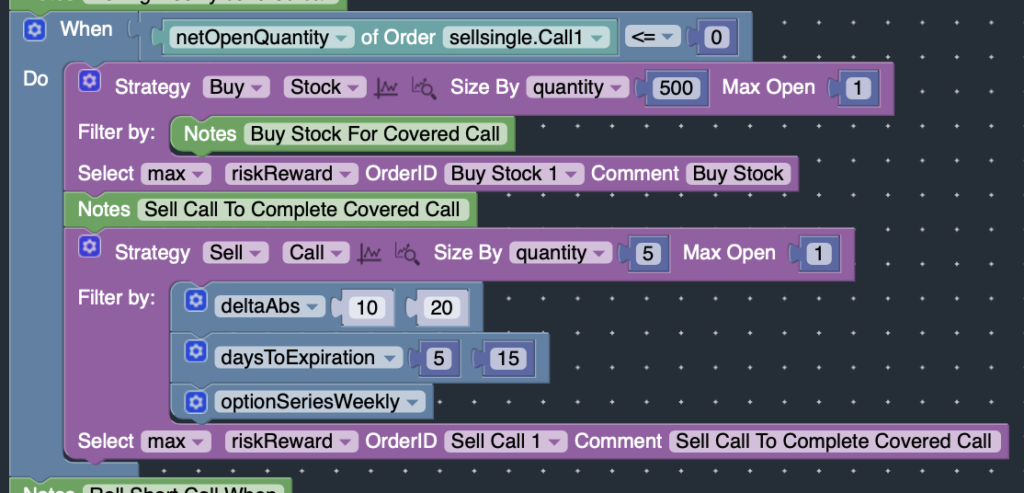

In this example, we will sell covered calls and roll the short call options whenever the extrinsic value of the short call is less than 20% of its current value.

We’ll enter a covered call with the following requirements:

- weekly options

- 5 – 15 days to expiration

- short strike between 10 – 20 delta

In general, if you want to roll only side side of a multi-legged spread instead of the entire spread (i.e. roll call vertical [bear call spread] in an iron condor without rolling the put vertical [bull put spread]), you should split the entire position into multiple positions such that each position can be rolled independently of the other.

Hence, in order to roll the short calls without rolling the stock, we will enter the covered call as two separate trades: (Buy Stock + Sell Short Call). That way we can roll the short calls without rolling the stock.

Define WHEN to enter the covered call:

- WHEN there are no open covered calls, sell a covered call (netOpenQuantity <= 0).

- Since stocks never expire, and we set the Max Open = 1 for stock, the stock transaction will only be executed once, and will stay open until explicitly closed.

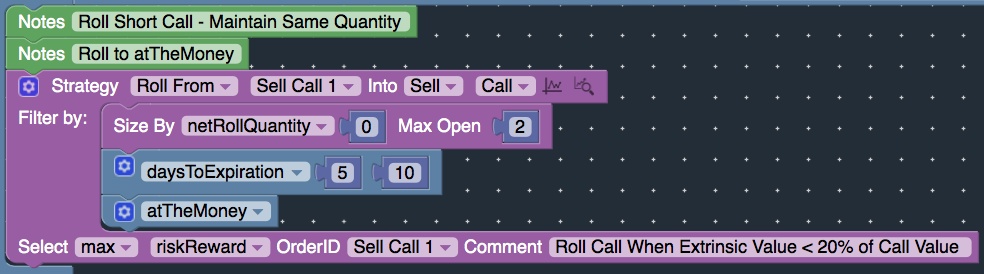

Define WHEN to roll the covered call:

- WHEN the extrinsic value of the short call option is less than 20% of its current market price. The extrinsic value and market price can be found in the Portfolio Studies block. (extrinsicValue <= 20% * midPrice)

Define rolling using the Strategy block as follows:

- Select “Roll From” as an action on the Strategy block

- Size By netRollQuantity equal to zero. Position size will remain the same as the original position being rolled. To increase position size, specify a positive quantity (i.e. +2). To decrease position size, specify a negative quantity (i.e -2).

- Roll the call to atTheMoney with 5-10 daysToExpiration.

Run Covered Call Example

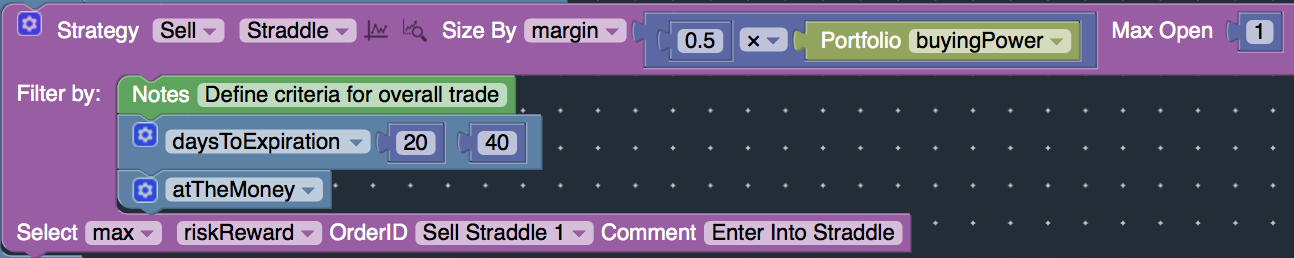

Rolling Straddles

In this example, we will sell a straddle and roll the straddle when losses exceed 50% of the credit received.

We’ll enter a straddle with the following requirements:

- 20 – 40 days to expiration

- atTheMoney strikes

We will roll the short short straddle whenever losses exceeds 50% of credit received. We will roll the short straddle to at the money. Furthermore, we’ll roll the spread for net zero cost by automatically increasing the position size as needed.

Define WHEN to roll:

- WHEN the straddle losses more than 50% of initial credit received:

- (returnOnMaxReward <= (-50%))

Define rolling using the Strategy block as follows:

- Select “Roll From” as an action on the Strategy block

- Size By netRollCost equal to zero. Position size will automatically increase / decrease to accomplish the roll for even or better.

- Roll further out in time (20 – 40 days) and at the money.

Run Straddle Example

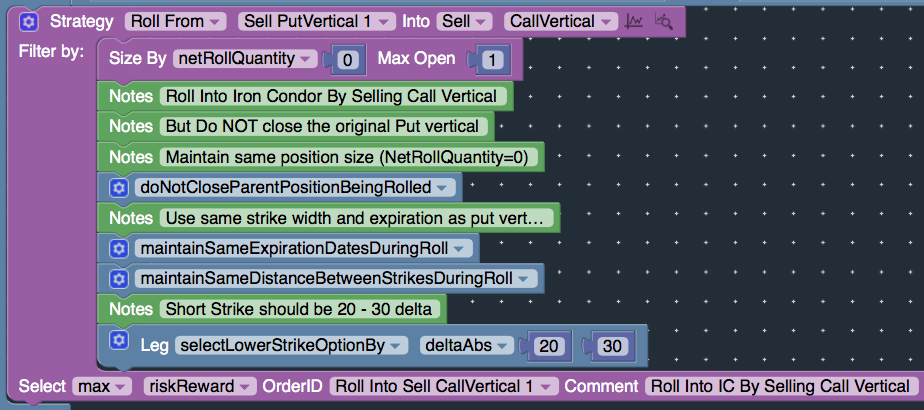

Legging into Iron Condors

Rolling can also be used to leg into a larger position. In this example, we will leg into an iron condor. We will start by selling a put vertical (bull put spread) and then sell a call vertical (bear call spread) when the breakeven point of the put vertical is hit.

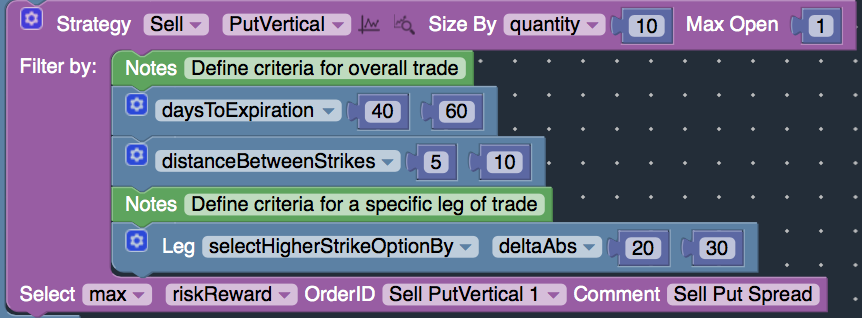

We will sell a put vertical (bull put spread) with the following requirements:

- Short Put Strike: 20 – 30 delta

- DaysToExpiration: 40 – 60 days

- DistanceBetweenStrikes: 5 – 10

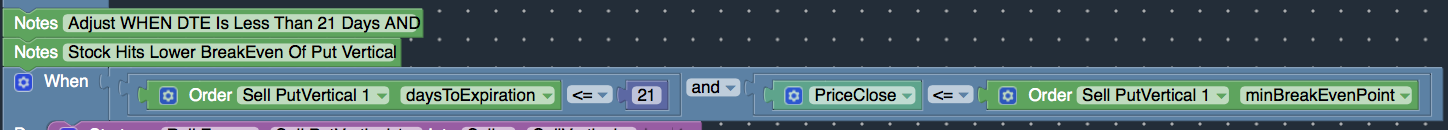

Define WHEN to leg into the call vertical (bear call spread):

- WHEN the underlying stock hits the breakeven point of the put vertical (bull put spread) and days to expiration is less than 21 days:

- (daysToExpiration <= 21) AND (PriceClose <= minBreakEvenPoint)

Define rolling using the Strategy block as follows:

- Select “Roll From” as an action on the Strategy block

- Size By netRollQuantity equal to zero so that the position size of the new call vertical will be the same as the existing put vertical.

- Since we are legging into the iron condor by selling a call vertical, we do not want to close the existing put vertical. So specify “doNotCloseParentPositionBeingRolled” so that existing put vertical remains open.

- In order for the new call vertical to maintain the same expiration and strike width of the put vertical, specify: “maintainSameExpirationDatesDuringRoll” and “maintainSameDistanceBetweenStrikesDuringRoll“

- Specify the delta of the new short call option: 20 – 30 delta