In this lesson you will learn how to create and backtest trading strategies to sell put options when a stock hits oversold conditions.

We will construct an options trading strategy that will sell put options when the underlying stock is considered oversold by the RSI indicator.

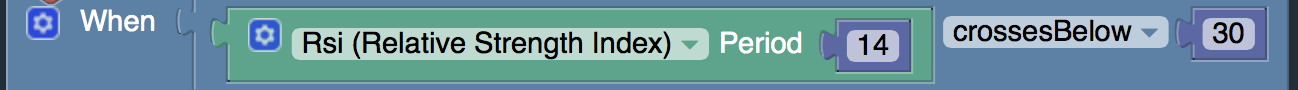

Specifically, we will sell put options whenever the RSI indicator crosses below 30, which is considered an oversold condition. And we will close the trade whenever the trade has achieved 80% of its max profit.

Simply click the “Run Backtest” button below to automatically get started.

Put Option

Selling a put is a strategy where an investor writes a put contract, and by selling the contract to the put buyer, the investor has sold the right to sell shares at a specific price.

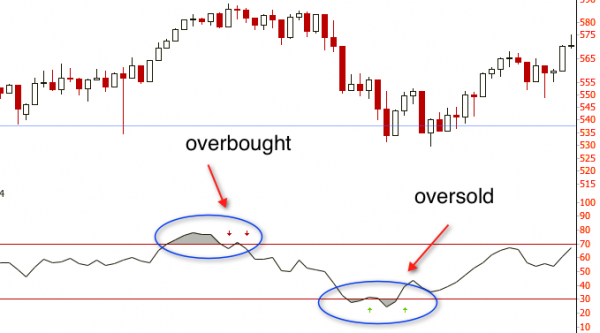

Oversold Indicators

One of the most common indicators of overbought or oversold conditions is the Relative Strength Index (RSI) indicator.

- In this example, we will create a strategy to sell out-of-the-money put options when the RSI crosses below 30 (an oversold condition). And close the trade when the trade has achieved 80% of its maximum profit.

- We will be using our Visual Interactive Development Environment (IDE) to create and backtest our strategies with a few clicks of the mouse.

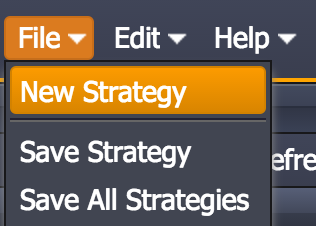

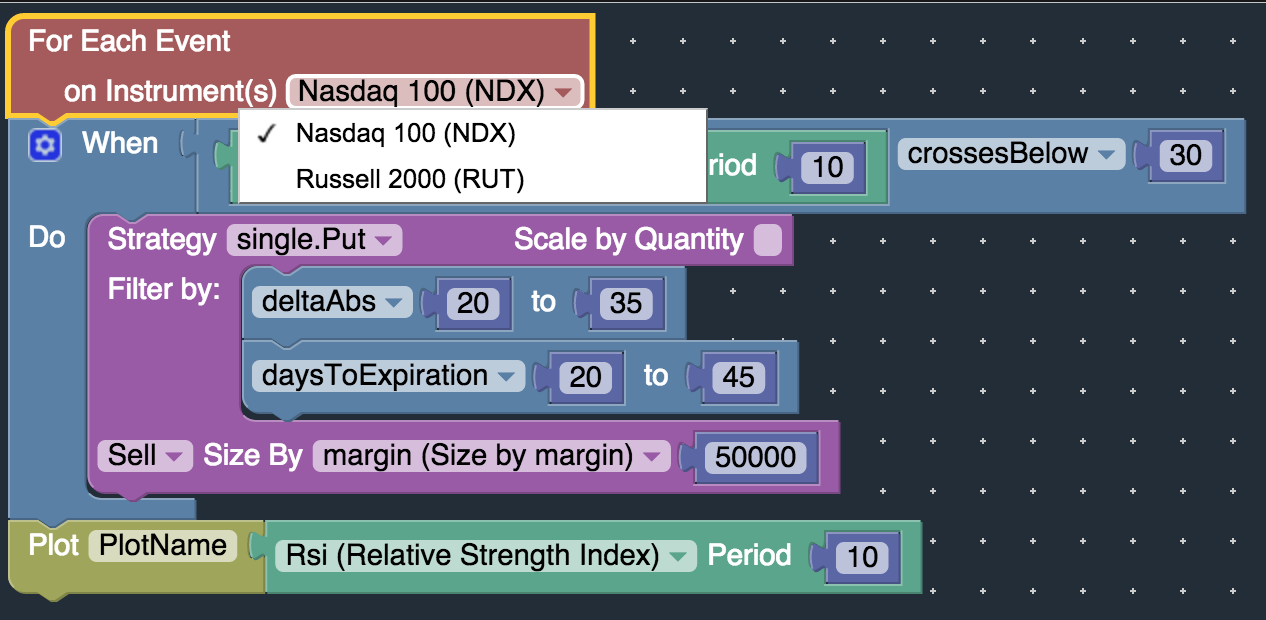

- First, login to the OptionStack platform. Select “New Strategy” from the “File” menu item

- Enter any arbitrary name you would like for the strategy

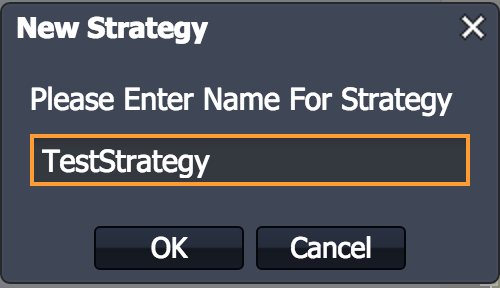

- A visual template will be automatically created for you. You will modify this template to define your trading rules.

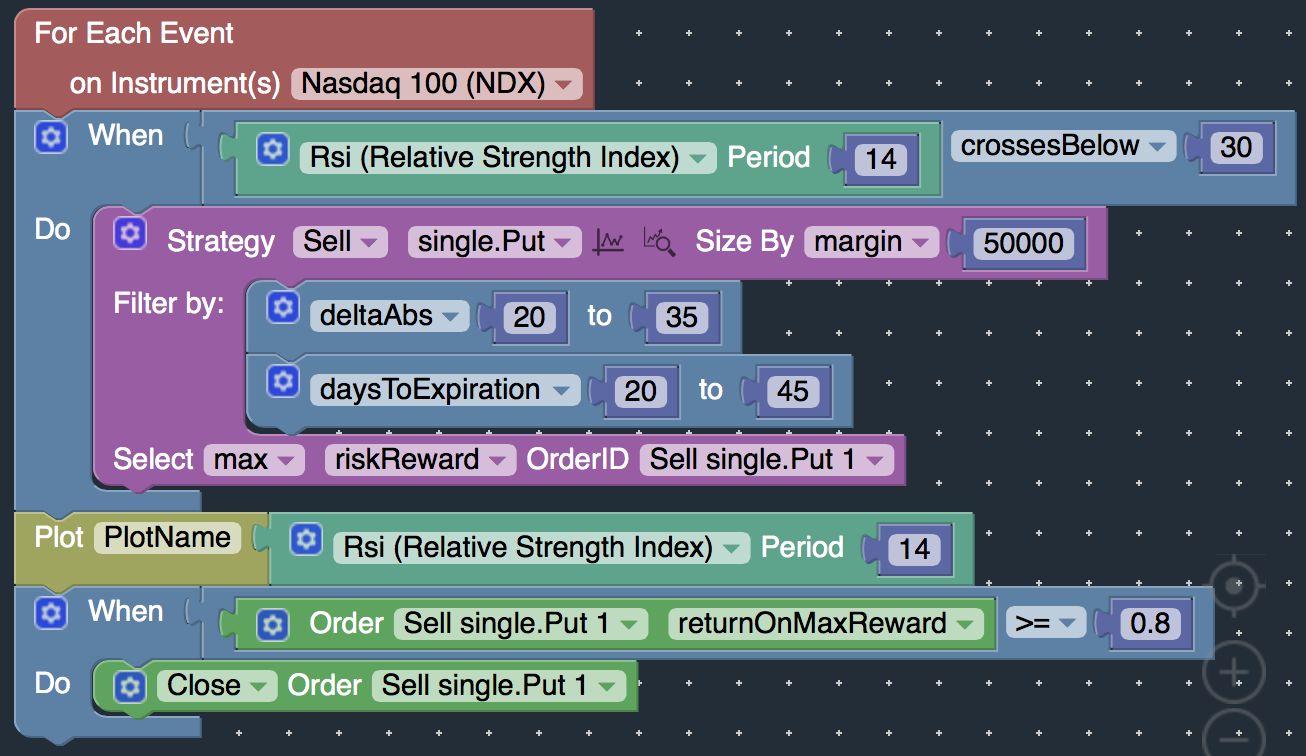

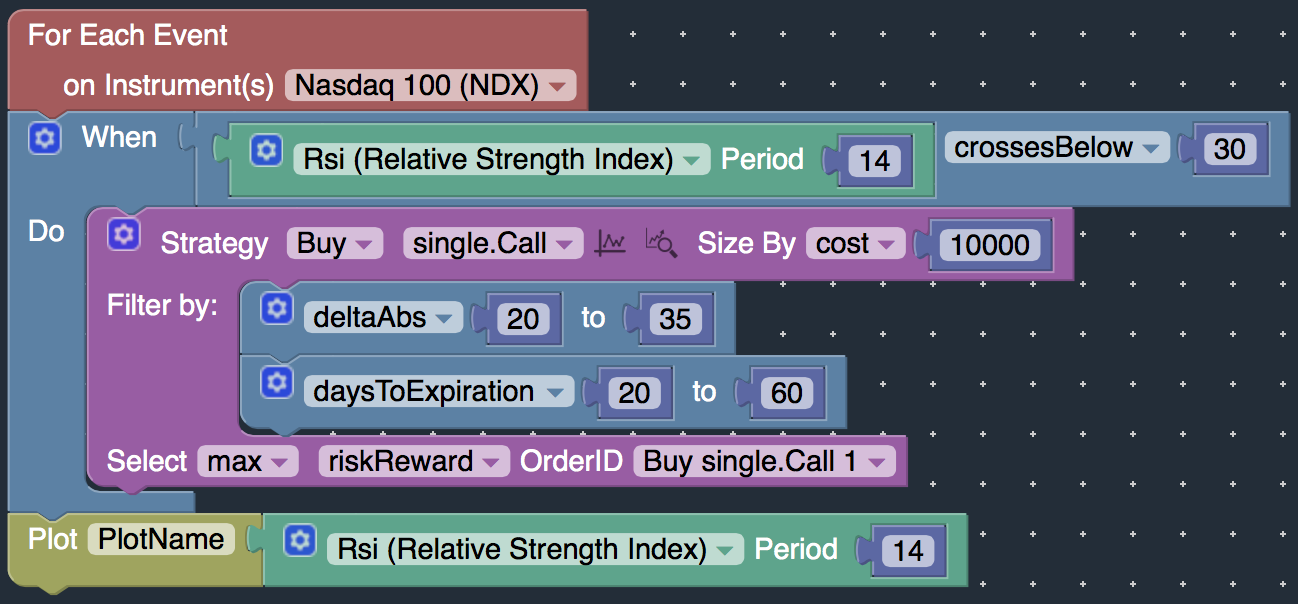

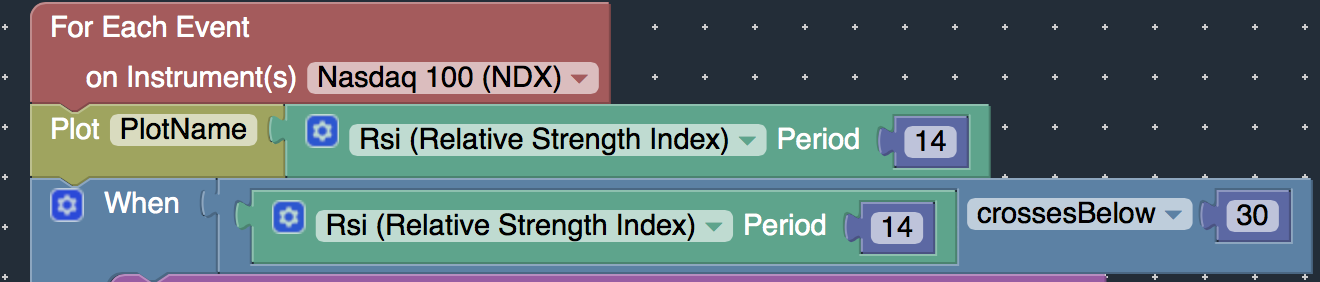

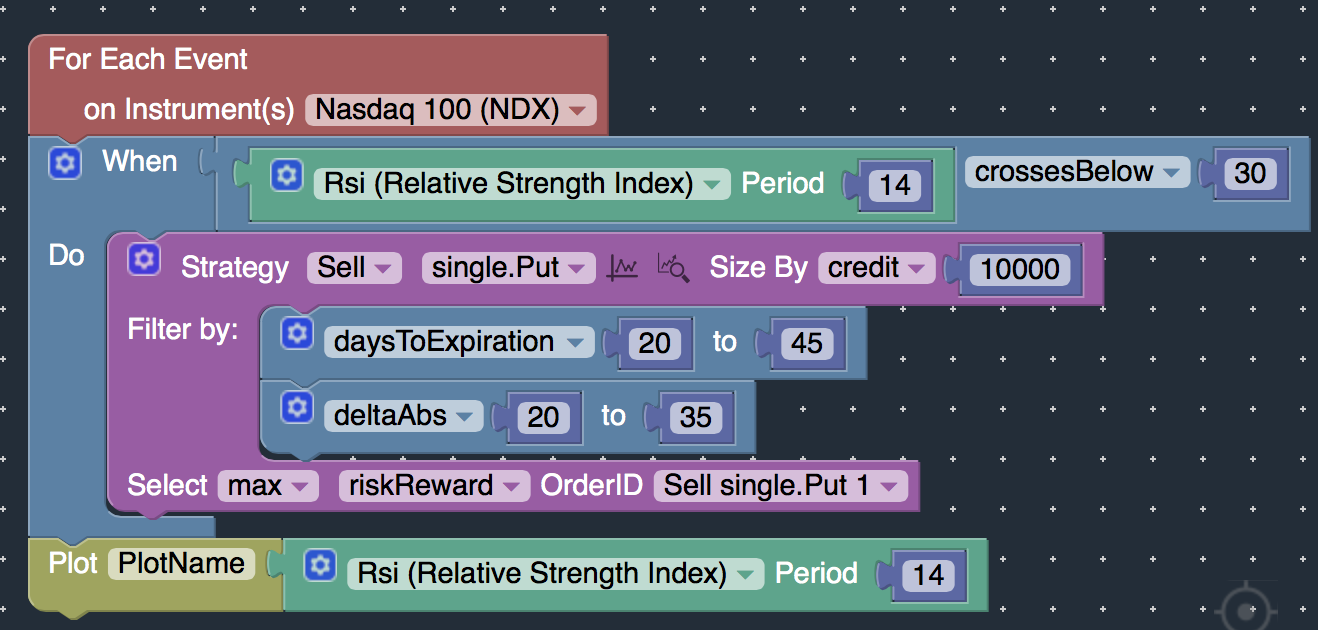

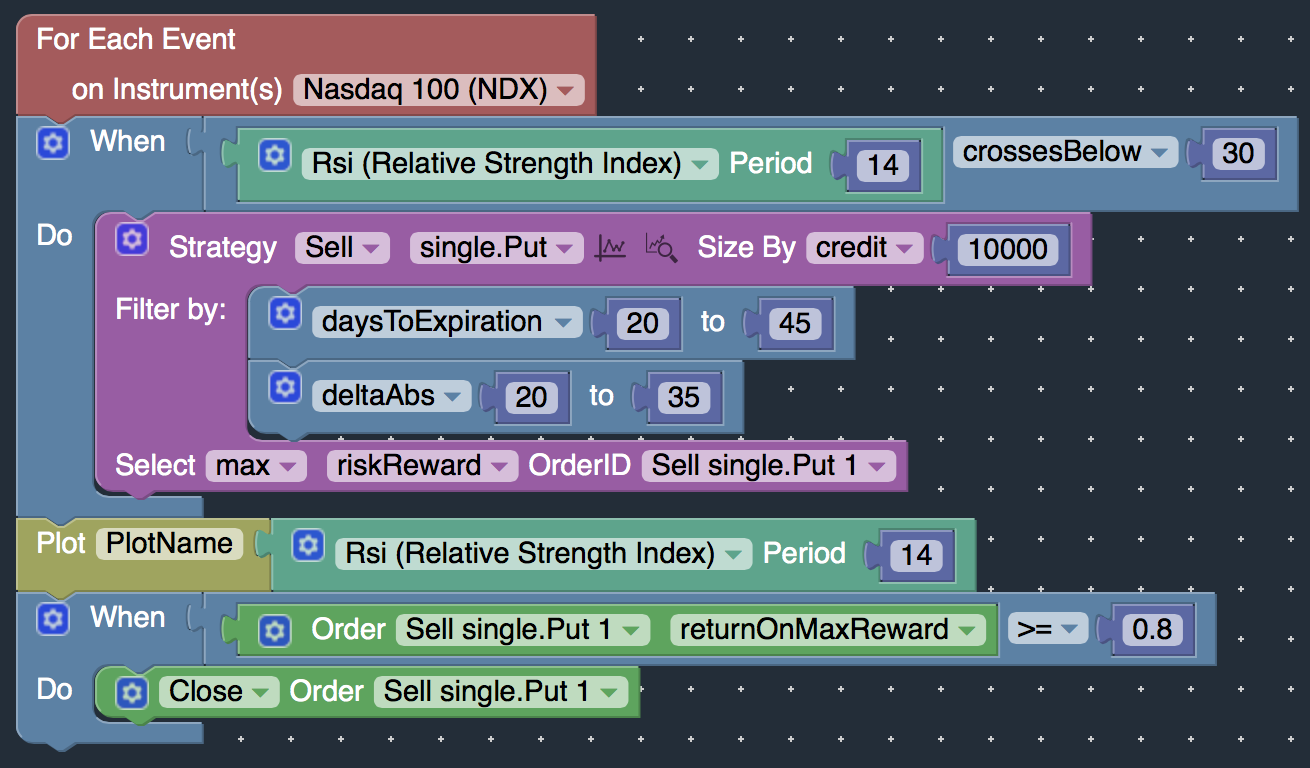

- In the IDE, define which stock you would like to trade. In this example, we will use the NDX (Nasdaq 100).

- We can plot the RSI to visualize the entry / exit points.

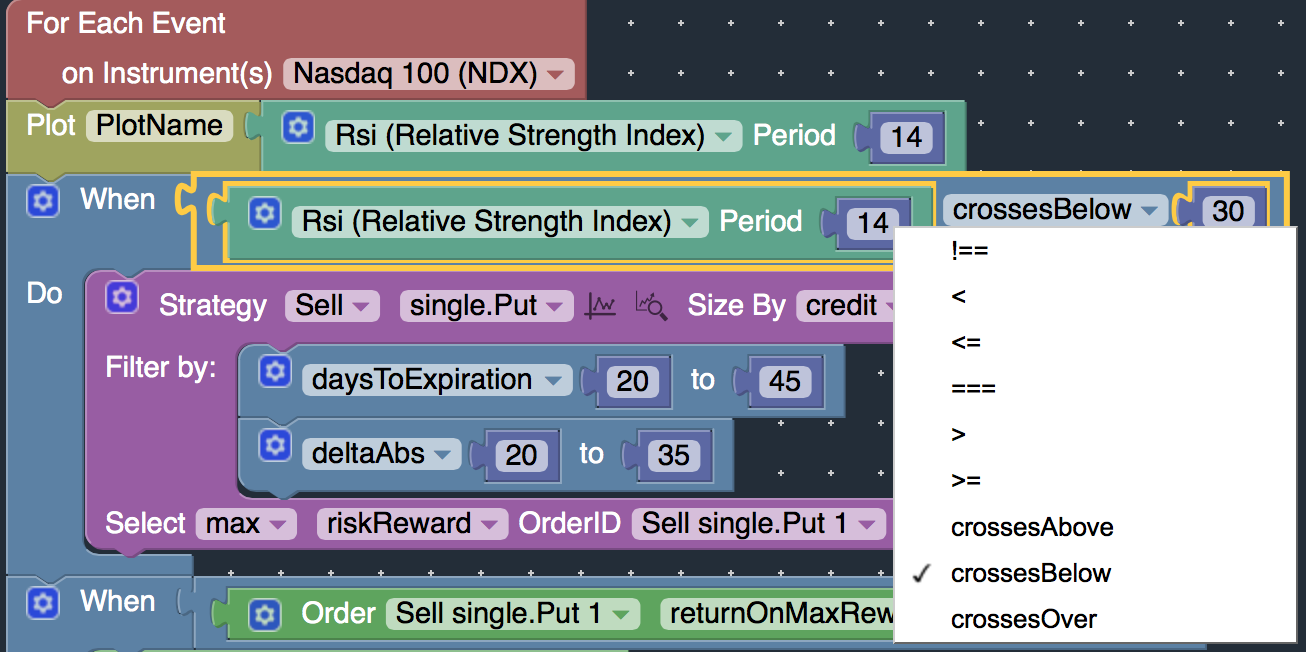

- Select the rule to check when the Relative Strength Indicator (RSI) crosses below 30.

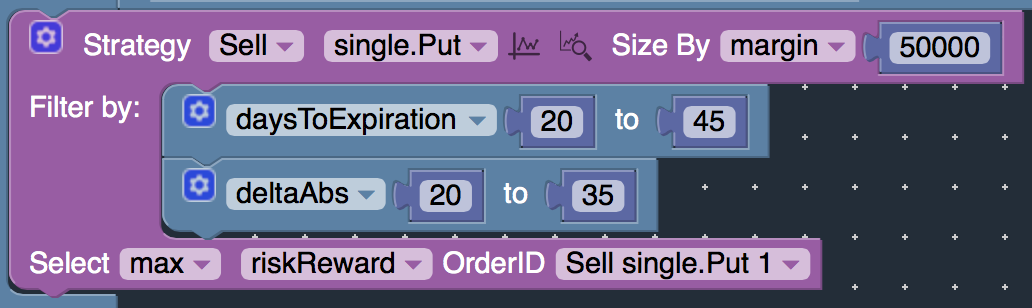

- Define which put option to sell using the Visual Option Spread Builder tool.

- In this example, we will sell out-of-the-money put with Delta between 20 – 35 and Days To Expiration between 20 – 45 days.

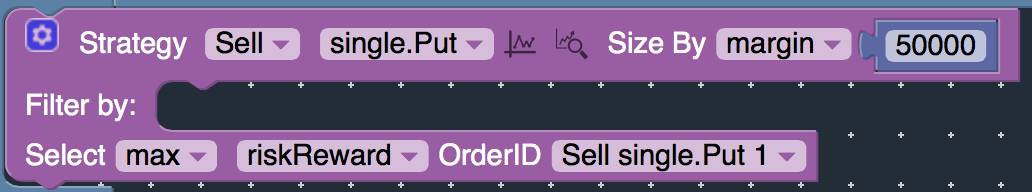

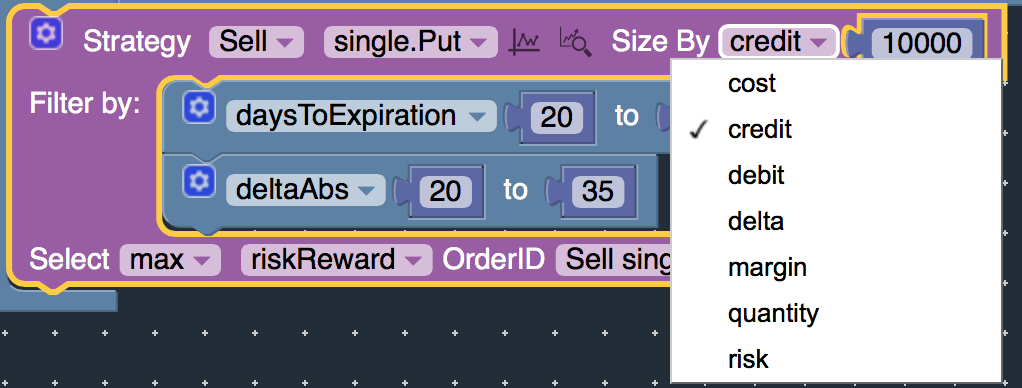

- Determine how many put options to sell.

- There are several ways to calculating the position sizing, such as quantity, cost, margin, risk, delta, etc.

- In this example, we will size based on credit received, where we will sell a quantity equal to about $10,000 in credit received.

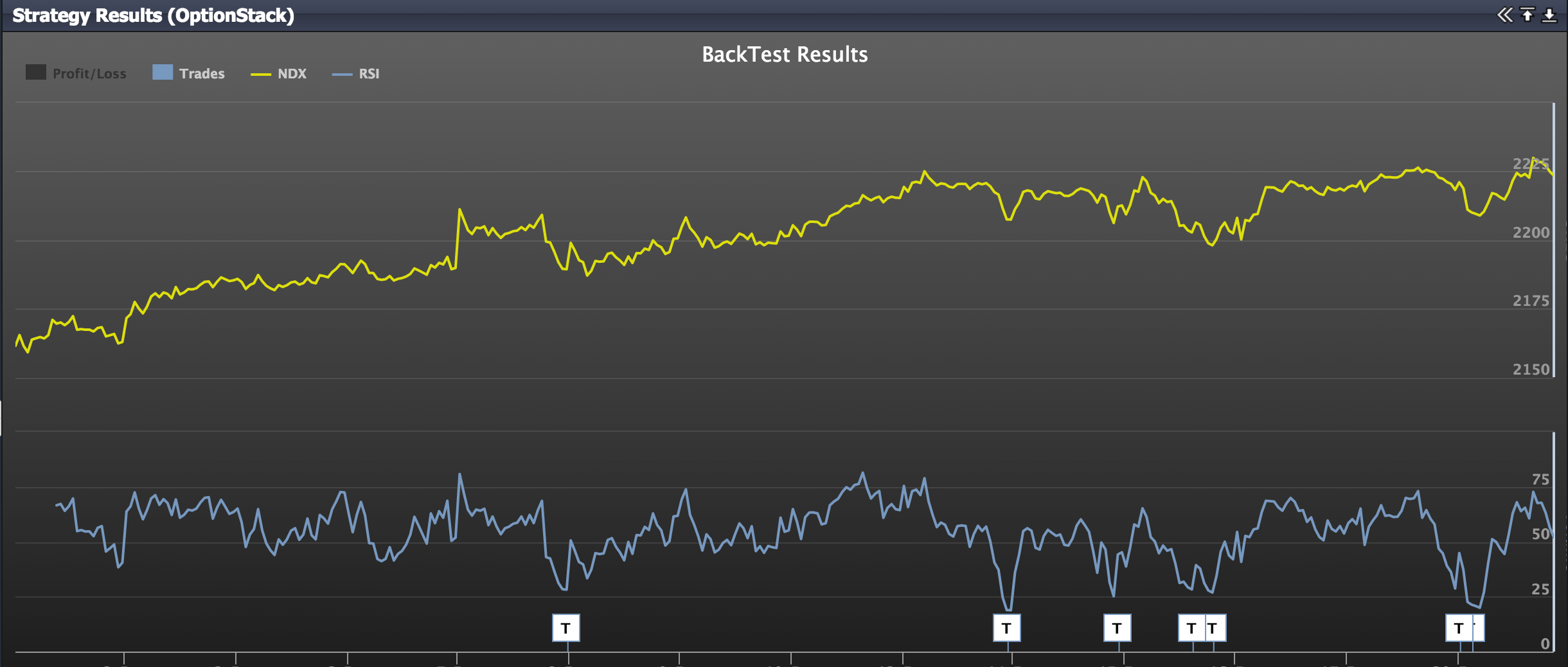

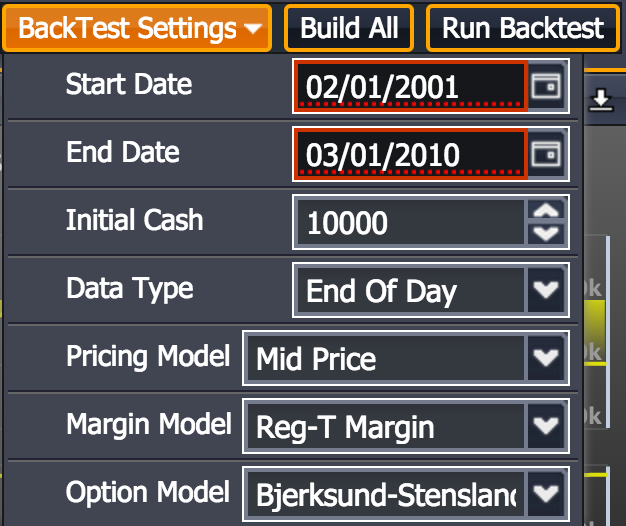

- Now that we have defined our model, we are ready to conduct our backtest.

- Before we run the backtest, first review the Backtest Settings.

- Once you have reviewed the backtest settings, click “Run Backtest”

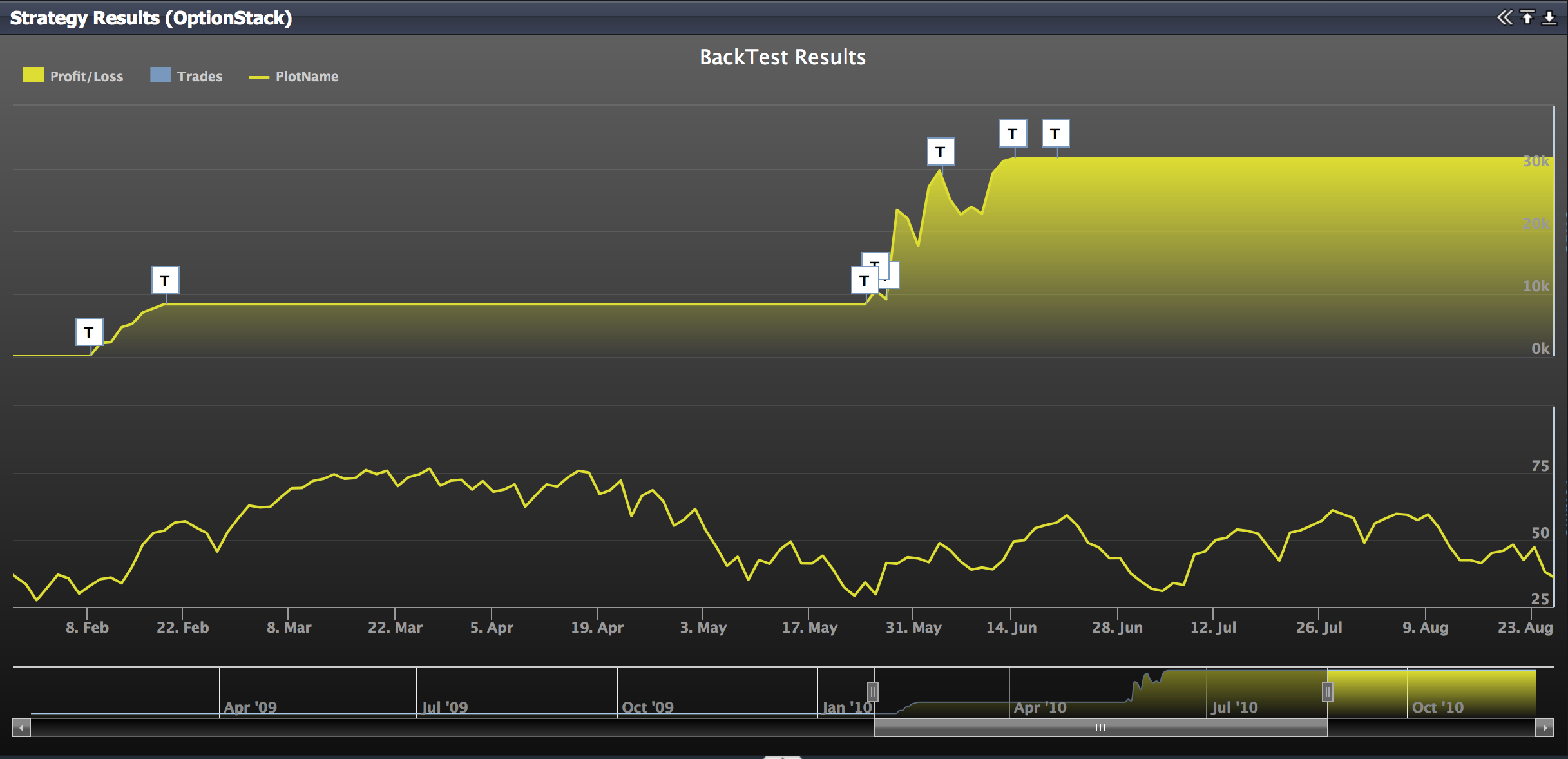

- Once you click “Run BackTest”, the OptionStack platform will automatically evaluate your strategy and provide you with the performance results.

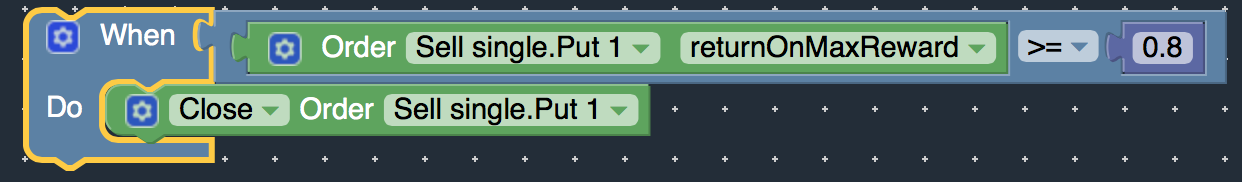

- Now, let’s define the rules to adjust the trade when certain market conditions are reached.

- Specifically, let’s close the trade when it has reached 80% of its maximum profit.

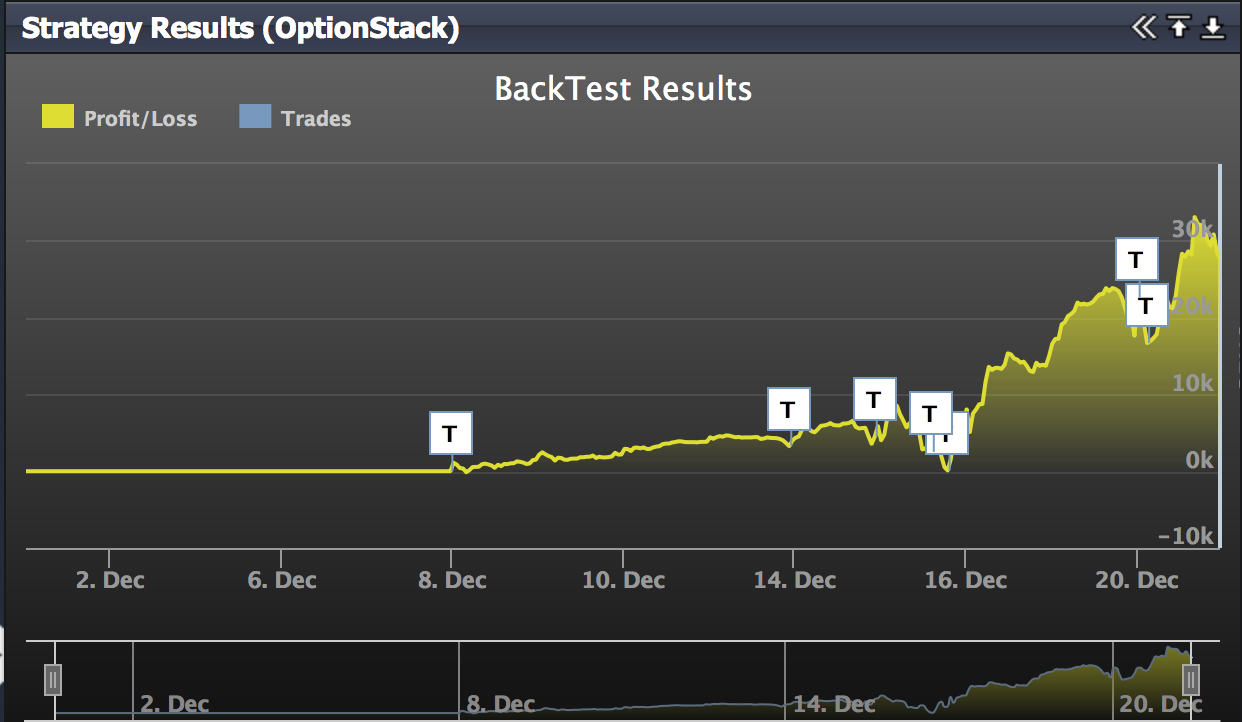

- As you can see from the charts, the different trading rules resulted in different performance results.

- The OptionStack platform makes it easy to modify and backtest various different trading strategies to maximize your profit.